GST Certificate Explained: Types, Benefits & Registration Process

Posted on January 27, 2026 by digifiling

Have you ever stared at a GST certificate & wondered what all those numbers & letters actually mean? You’re not alone! Thousands of business owners across the country face the same confusion every single day. GST certificates might seem like complicated pieces of paper, but they’re actually your golden tickets to running a legal & profitable business. Think of them as your business passport – without them, you can’t really travel in the commercial world.

This comprehensive guide will walk you through everything you need to know about GST certificates. We’ll break down the complex. From understanding what GST certificates actually are to learning how to obtain them, we’ll cover every important detail. You’ll discover the different TYPES of certificates available, learn about the application process, & understand why these documents are so crucial for your business success.

By the end of this article, you’ll feel confident about handling GST certificates like a seasoned professional. We’ll also share some insider tips & tricks that can save you time, money, & headaches. Whether you’re a new business owner or someone who’s been struggling with GST documentation, this guide will transform you from confused to confident. Ready to become a GST certificate expert? Let’s dive in!

What Exactly ARE GST Certificates?

GST certificates are official documents issued by the government that prove your business is registered to collect & pay Goods & Services Tax. Think of them like a driver’s license, but for conducting business legally. Just as you need a license to drive a car, you need a GST certificate to sell goods or provide services above certain income levels. These certificates contain unique identification numbers that help the government track business transactions & ensure everyone pays their fair share of taxes.

The certificate shows important information about your business, including your legal name, address, & the types of goods or services you’re allowed to sell. It’s like having an official stamp of approval that says “Yes, this business is legitimate & follows all the rules.” Without this certificate, customers might question whether your business is trustworthy, & you could face serious legal problems.

Most importantly, these certificates allow you to claim input tax credits. This means if you buy materials or services for your business & pay GST on them, you can get that money back when you file your taxes. It’s like getting a discount on everything you buy for your business! For example, if you run a bakery & buy flour, sugar, & other ingredients, you can claim back the GST you paid on those purchases. This system helps businesses avoid paying tax on tax, which would make everything much more expensive for everyone.

Different Types Of GST Certificates You Should Know

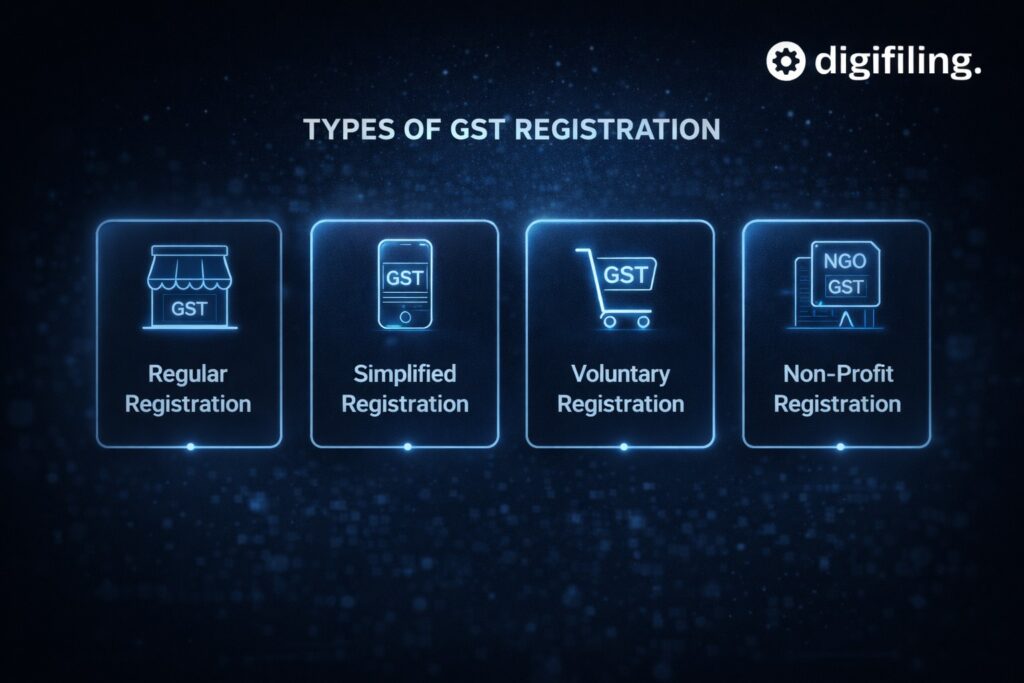

There isn’t just one type of GST certificate – there are actually several different kinds depending on your business size & needs. The most common type is the Regular GST Registration certificate, which most businesses get when they start earning more than $30,000 per year. This certificate allows you to charge GST to your customers & claim input tax credits on your business purchases.

Small businesses might qualify for a Simplified Registration, which has fewer reporting requirements but still gives you most of the same benefits. Think of it as the “lite” version of GST registration – it has all the essential features but without some of the complicated paperwork. This option is perfect for businesses that don’t have complex operations or lots of different income sources.

There’s also something called Voluntary Registration, which allows businesses earning less than $30,000 to still get a GST certificate if they want one. Why would someone choose to register voluntarily? Well, having a GST certificate makes your business look more professional & credible. Plus, you can still claim those valuable input tax credits we talked about earlier. Some businesses find that the benefits outweigh the extra paperwork, especially if they buy expensive equipment or supplies for their operations.

Non-profit organizations & charities can get special GST certificates too. These certificates recognize that these organizations operate differently from regular businesses & have different tax obligations. The government understands that a charity raising money for a good cause shouldn’t be treated exactly the same as a company trying to make profits.

How to GET Your GST Certificate: Step-by-Step Process

Getting your GST certificate isn’t as scary as it might seem, but you do need to follow the right steps. First, you’ll need to gather all your business documents, including your business registration papers, proof of address, & identification documents. It’s like preparing for a job interview – you want to have everything organized & ready to go before you start the application process.

The easiest way to apply is through the government’s online portal. You’ll create an account, fill out the application form, & upload all your documents digitally. The online system is available 24/7, so you can work on your application whenever it’s convenient for you. Most people find the online process much faster & easier than trying to deal with paper forms & mail.

After you submit your application, the government will review everything to make sure it’s complete & accurate. This usually takes a few weeks, but it can sometimes take longer during busy periods. Don’t panic if you don’t hear back immediately – the government processes thousands of these applications every month. They’ll contact you if they need any additional information or if there are any problems with your application.

Once your application is approved, you’ll receive your official GST certificate. Make sure to keep this document safe & easily accessible, because you’ll need to show it to customers, suppliers, & other businesses. Many business owners frame their certificate & hang it in their office or store, both to keep it safe & to show customers that they’re a legitimate, registered business.

Why GST Certificates Matter MORE Than You Think

Having a GST certificate does much more than just keep you legal – it actually opens doors to new business opportunities. Many large companies & government organizations will only work with businesses that have valid GST certificates. This means that without a certificate, you might miss out on lucrative contracts & partnerships that could help your business grow significantly.

Think about it from a customer’s perspective. If you’re choosing between two similar businesses, & one has a GST certificate while the other doesn’t, which one would you trust more? The registered business appears more professional, established, & trustworthy. This credibility can be especially important when you’re trying to attract new customers or negotiate better deals with suppliers.

GST certificates also make your accounting & bookkeeping much cleaner & more organized. When you’re registered for GST, you need to keep better records of all your income & expenses. While this might seem like extra work at first, it actually helps you understand your business finances much better. You’ll know exactly how much money is coming in, where it’s being spent, & how profitable different parts of your business really are.

The input tax credit system can save your business thousands of dollars every year. Every time you buy something for your business – whether it’s office supplies, equipment, or raw materials – you can claim back the GST you paid. Over time, these savings really add up & can make a significant difference to your bottom line. Some businesses find that their GST savings are enough to hire an additional employee or invest in new equipment!

Common Mistakes to AVOID & Pro Tips

One of the biggest mistakes new business owners make is waiting too long to register for GST. Some people think they’ll register “eventually” or “when they get bigger,” but this approach can cost you money. Remember, you can claim input tax credits on business purchases even before you start earning significant income. If you’re buying equipment, supplies, or other business necessities, you might be leaving money on the table by not registering sooner.

Another common error is not keeping proper records once you get your certificate. The government requires GST-registered businesses to maintain detailed records of all transactions, income, & expenses. This doesn’t mean you need to become an accounting expert overnight, but you do need to develop good organizational habits. Consider investing in simple accounting software or working with a bookkeeper to make sure everything stays organized & compliant.

Many business owners also forget to update their certificate information when things change. If you move your business to a new location, change your business name, or significantly alter what products or services you offer, you need to notify the government & update your registration. Failing to do this can lead to complications & potentially even penalties down the road.

Here’s a pro tip that many successful business owners swear by: always display your GST certificate prominently in your place of business or include your GST number on all your invoices & business communications. This simple step immediately signals to customers, suppliers, & partners that you’re a legitimate, professional operation. It’s a small detail that can make a big difference in how people perceive your business.

GST certificates might seem intimidating at first, but they’re actually powerful tools that can help your business succeed & grow. We’ve covered everything from the basics of what these certificates are to the practical steps of getting one & using it effectively. Remember, having a GST certificate isn’t just about following the law – it’s about positioning your business for success, credibility, & profitability.

The key takeaway is that GST registration is generally beneficial for most businesses, even if it’s not legally required yet. The combination of input tax credits, increased credibility, & access to new business opportunities usually outweighs the additional paperwork & responsibilities. Think of your GST certificate as an investment in your business’s future rather than just another bureaucratic requirement.

Don’t let fear or confusion hold you back from taking this important step. The application process is straightforward, & there are plenty of resources available to help you succeed. If you’re still feeling uncertain, consider consulting with an accountant or business advisor who can provide personalized guidance based on your specific situation.

Take action today! If your business is approaching the registration threshold, or if you think voluntary registration might benefit you, start gathering your documents & begin the application process through Digifiling. Your future self will thank you for making this smart business decision now rather than waiting until later.